Pkf Advisory Services Fundamentals Explained

Pkf Advisory Services Fundamentals Explained

Blog Article

Top Guidelines Of Pkf Advisory Services

Table of ContentsPkf Advisory Services Fundamentals ExplainedThe 7-Second Trick For Pkf Advisory ServicesThe Facts About Pkf Advisory Services RevealedThe Definitive Guide for Pkf Advisory Services7 Simple Techniques For Pkf Advisory Services

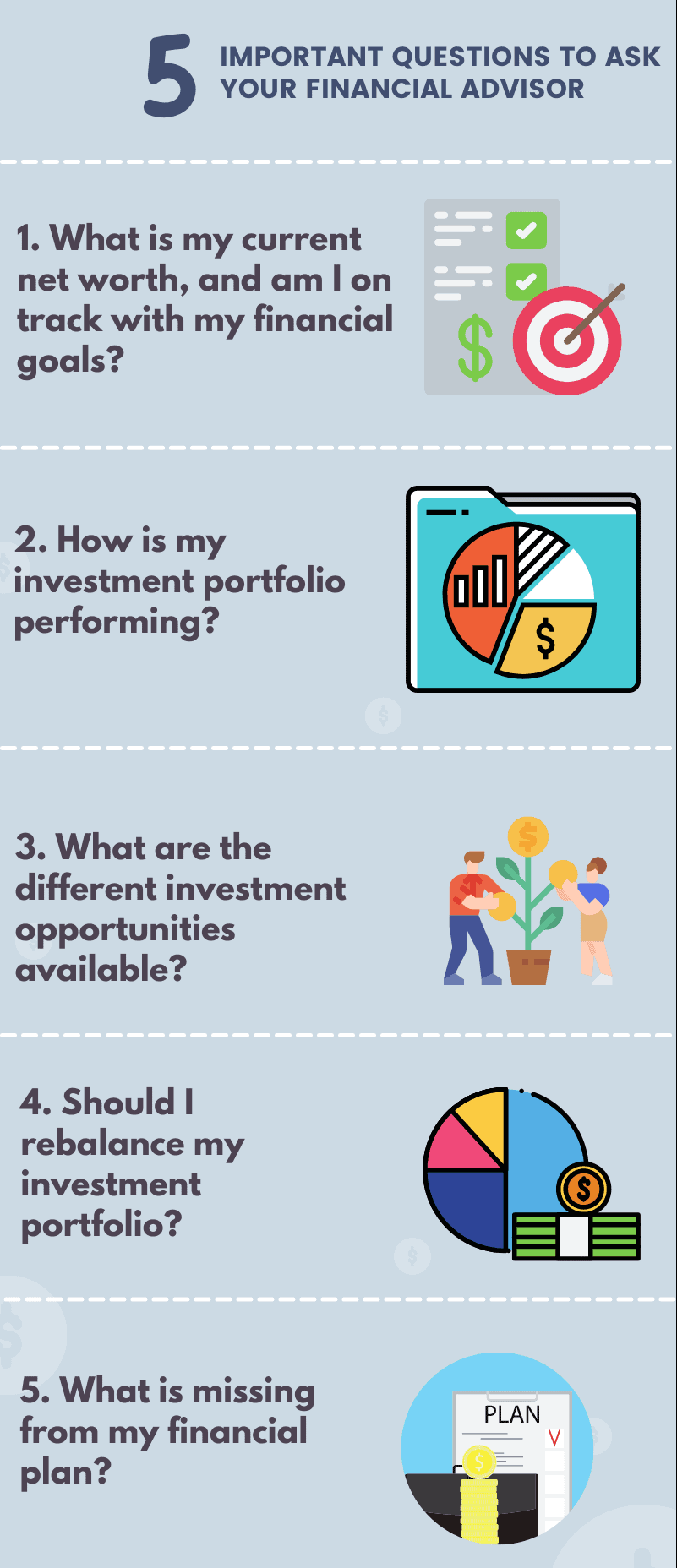

Understanding that you have a strong financial plan in location and expert guidance to transform to can reduce anxiety and improve the high quality of life for many. Expanding access to financial advice might also play an important duty in lowering riches inequality at a social degree. Frequently, those with lower earnings would benefit the most from economic advice, however they are additionally the least likely to afford it or recognize where to seek it out.What may come to mind is someone in a suit resting across from you in a dark workplace, using unknown terms and charging a whole lot of cash for their time. This understanding holds many individuals back. Traditional financial recommendations models usually offered wealthier individuals in person. However this is transforming. Versions of monetary recommendations are currently typically hybrid, and some are also digital-first.

The Ultimate Guide To Pkf Advisory Services

There is now an advancing breadth of recommendations designs with a series of pricing frameworks to suit a slope of customer requirements. Another significant obstacle is a lack of count on economic consultants and the suggestions they offer. In Europe, 62% of the adult population is not certain that the financial investment advice they obtain from their financial institution, insurance company, or monetary adviser is in their ideal rate of interest.

The future defined right here is one where economic health is accessible for all. It is a future where monetary guidance is not a deluxe however a vital solution accessible to every person. The benefits of such a future are far-reaching, yet we have a long way to go to reach this vision.

Marital relationship, divorce, remarriage or just relocating in with a new companion are all turning points that can require mindful planning. For instance, together with the typically difficult psychological ups and downs of separation, both companions will have to handle vital economic considerations. Will you have adequate earnings to support your way of living? Just how will your investments and other assets be split? You might extremely well need to change your monetary approach to keep your objectives on track, you can try here Lawrence says.

An abrupt influx of cash or possessions increases immediate questions regarding what to do with it. "A monetary consultant can aid you think with the ways you might place that money to work toward your personal and economic goals," Lawrence says. You'll want to think about how much could most likely to paying down existing financial debt and just how much you might take into consideration investing to go after a more safe and secure future.

The Basic Principles Of Pkf Advisory Services

No 2 people will have fairly the exact same set of investment methods or services. Depending on your objectives as well as your tolerance for risk and the time you have to pursue those objectives, your advisor can aid you recognize a mix of financial investments that are appropriate for you and made to aid you reach them.

Throughout these conversations, gaps in current techniques can be determined. A critical benefit of creating a strategy is having an extensive view of your financial situation. When you can see the entire photo, it's less complicated to see what's missing. When life adjustments and you hit a bump on your economic roadmap, it's very easy to obtain off track.

Some Known Questions About Pkf Advisory Services.

Will I have sufficient conserved for retired life? A detailed, written strategy offers you a clear picture and direction for methods to reach your objectives.

It is therefore not surprising that among the participants in our top article 2023 T. Rowe Cost Retired Life Cost Savings and Spending Study, 64% of baby boomers reported moderate to high degrees of stress and anxiety concerning their retirement savings. When preparing for retirement, individuals might gain from educational sources and digital experiences to help them compose a formal strategy that details anticipated expenditures, revenue, and asset administration techniques.

Producing a formal written prepare for retirement has revealed some important advantages for preretirees, including enhancing their self-confidence and exhilaration about retired life. Most of our preretiree survey participants were either in the process of developing a retirement or thinking of it. For preretirees that were within five years of retired life and for retirees in the five years after their retirement day, data showed a purposeful boost in official retirement preparation, consisting of seeking assistance from an economic consultant (Fig.

How Pkf Advisory Services can Save You Time, Stress, and Money.

(Fig. 1) Resource: T. Rowe Rate Retired Life Financial Savings and Spending Study, 2023. Numbers may not complete 100% due to rounding. Preretirees may find worth in a series of solutions that will certainly help them prepare for retired life. These can consist of specialized education and learning to assist with the withdrawal and income stage or with key decisions such as when to accumulate Social Safety and security.

Report this page